I have spent the past two years interviewing dozens of rail industry professionals to get a better understanding of how wheelset maintenance, which can comprise as much as 75% of a railcar’s anticipated maintenance spend, is performed in the industry. The responses have been both illuminating and frankly, shocking. One main theme has repeatedly surfaced: Car owners feel the railroads are taking advantage of them on wheelset maintenance, but there’s such a lack of transparency in the system, that they are at a loss as to what is actually happening. In fairness to the railroads, I do not believe that this is their primary intention. Rather, with maintenance practices being driven by inaccurate and overextended wayside systems, railcar maintenance is performed too frequently and at a higher cost while creating no additional safety benefit.

The reason I’m choosing to write about this topic now came from another half dozen conversations I had recently about this issue. It’s almost the worst kept secret in the industry, yet car owners and shippers, even major, well-resourced players, are paying enormous amounts of money to railroads for their wheelset maintenance - far more than they need to. As I often heard when I started working in a shipper’s railyard fresh out of college, “Railroads gonna do what railroads gonna do,” so many car owners may feel like there’s no other option. Fortunately, with dramatic advances in low power, wireless sensors and battery technology, there is.

Disclaimer – Some of the numbers and examples provided are generalized to provide the broadest picture of what is occurring across the industry. Each shipper, car owner, and car type are unique so this may not match your own experience exactly. The underlying conditions that have allowed railroads to become the de facto rulers of railcar maintenance are still true regardless.

First for some background for the casual observer: Running Repairs are repairs performed by a railroad on a railcar that is not owned by that railroad, often when prompted by inspection or wayside monitoring. In the case of wheelsets, there are three primary triggers for wheelset replacement by a railroad: hot box detector (HBD) alert, acoustic bearing detector (ABD) alert, and wheel impact load detector (WILD) alert. Collectively, HBDs, ABDs, and WILDs are all forms of wayside detectors.

Wayside detectors are monitoring equipment installed next to rail track to provide some level of diagnostics of rolling stock as they pass. Starting with HBDs which were first developed back in the 1950’s, wayside detection was primarily used as a last line of defense in preventing catastrophic derailments caused by failed wheels and bearings. This was especially important when railcars still had open journal boxes that required lubricating oil to be topped off periodically. Any modern mechanical reliability engineer with their advanced oil filtration methods and optimized lubrication schedules would have a heart attack if they saw this practice. And for good reason, as derailments from overheated bearings were a frequent issue.

Over time, additional failure detection methods like ABDs and WILDs were installed. Derailments plummeted as bearing OEMs improved manufacturing practices from the feedback loop that wayside detectors started to provide. However, as shown in the graph below, derailments have long since stagnated, indicating a limitation for wayside detection to drive any further decrease in derailments.

Additionally, known limitations of wayside detectors like HBDs, which only monitor for high, sustained bearing temperatures, have still resulted in preventable accidents. Some of the more notable accidents were the 2013 CP derailment that resulted in knocking out a bridge despite passing several HBDs, and the 2015 CSX derailment of a highly toxic acrylonitrile tank car where an HBD as close as 18 miles from the derailment site failed to provide an alert.

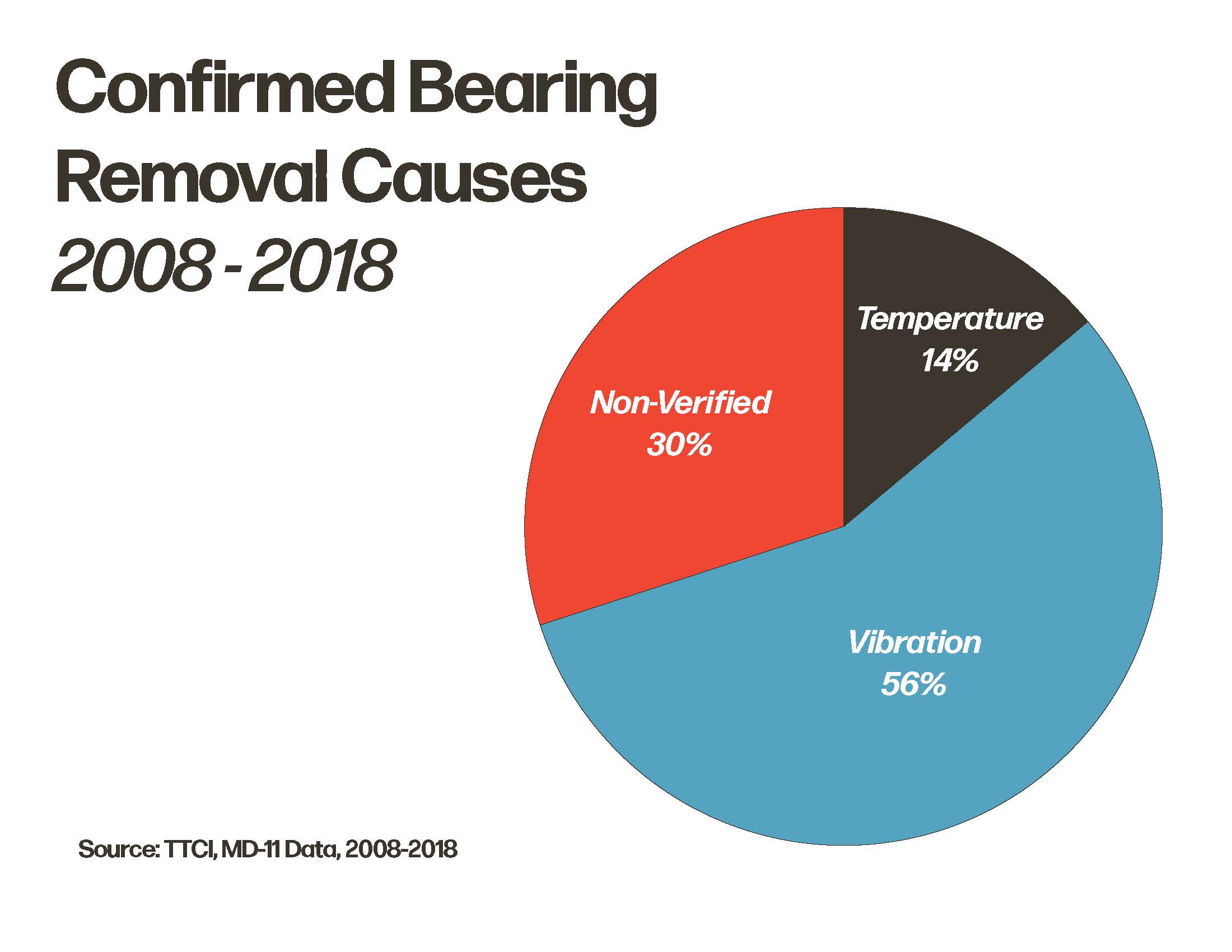

Failures like these haven’t seen HBDs fall out of favor, however, as there are an estimated 6,600 installations across North America. Yet a review of MD-11 data, which is the AAR classification for a bearing tear down report after they have been flagged by a wayside detector and removed from service, shows two problematic issues with the widespread use of HBDs. First, 30% of bearings removed from service were classified as “Non-verified”, which is an indication that the bearing had no identifiable defects when analyzed. Second, only 14% of bearings analyzed were found to have damage caused by high temperature. While HBDs may work fine as a last line of defense against a catastrophic derailment, they are a terrible preventative or even predictive maintenance tool despite being used by railroads for that exact purpose.

While there are several reasons for the inaccuracy of HBDs, most notably the constant need for calibration and a difficulty in measuring various bearing types, it is more important to know that temperature in general is a very poor predictive indicator of bearing failure, often only becoming noticeable just before complete failure.

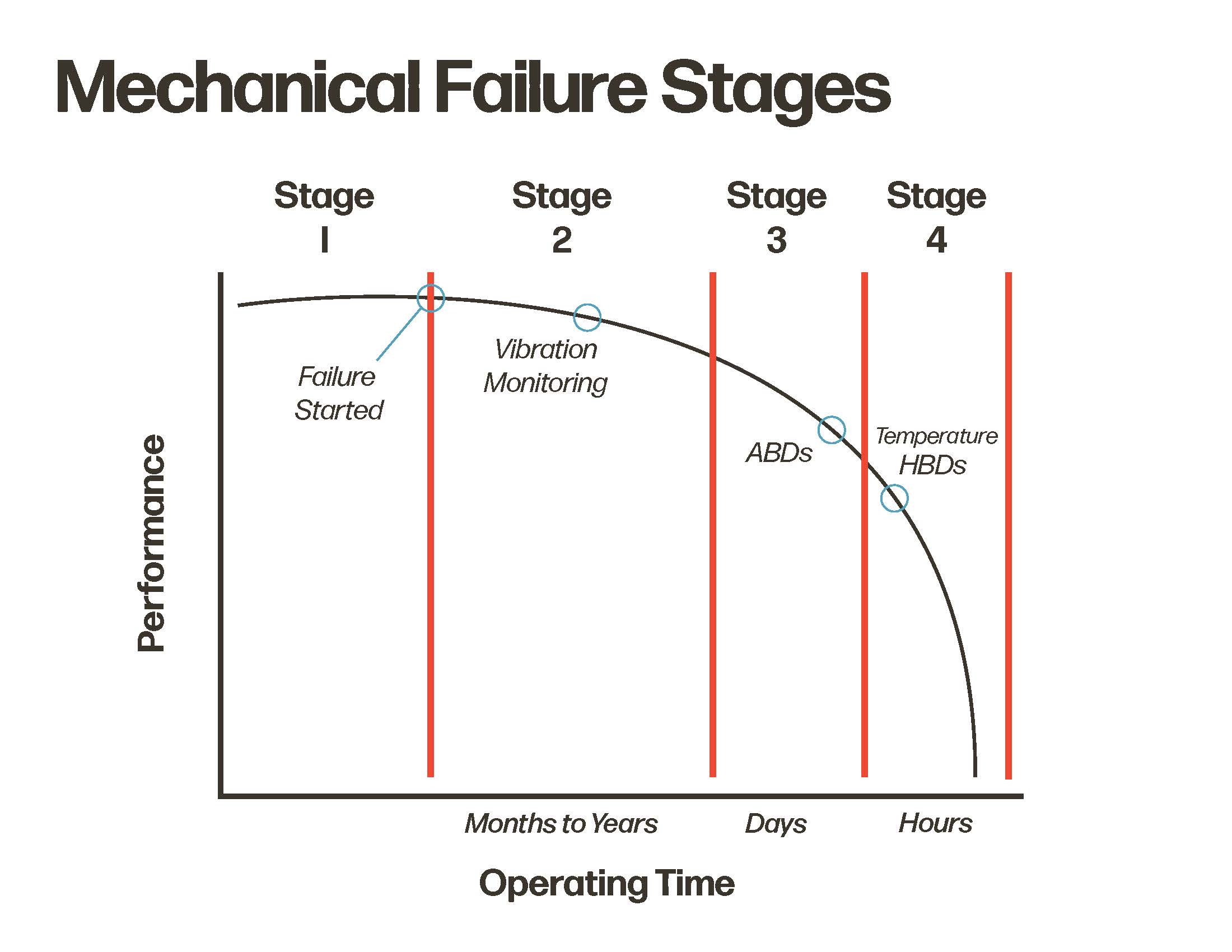

As shown in the graph below, there are essentially 4 stages of bearing failure. During Stage 1 a new bearing is “broken in” and shows no signs of damage. Once broken in, this stage can last for hundreds of thousands of miles, keeping in mind that the design life of an AAR Class K bearing is approximately 1.2 million miles. Stage 2 begins when a subsurface crack initiates on a defect in the bearing and continues until that crack grows under repeated stress to break off as a "spall".

As the spalled area grows, it moves from Stage 3 to Stage 4,when enough material has come off and has become entrained in the grease (I call this “loose change” rattling around) which causes a considerable amount of friction to be applied to the bearing. All of this friction from entrained metal creates a rapid temperature increase as the lubrication breaks down and eventually the bearing can cease to rotate. The rollers rotating over these defects can be heard audibly (sometimes called a “growler”), and the quick temperature spike is visible to a HBD.

Acoustic bearing detectors improve upon some of the flaws of HBDs, but not by much. ABDs are capable of identifying a much larger portion of bearing failure causes (56%) as they pick up on vibration rather than temperature. However, bearings don’t become audible until the surface area of spalled material is large enough to cause the level of acoustic noise needed to “hear” the defect. Additionally, for an ABD to get accurate readings, a train has to pass it at just the right rotational frequency (often 50 mph), otherwise the data collected are highly inaccurate.

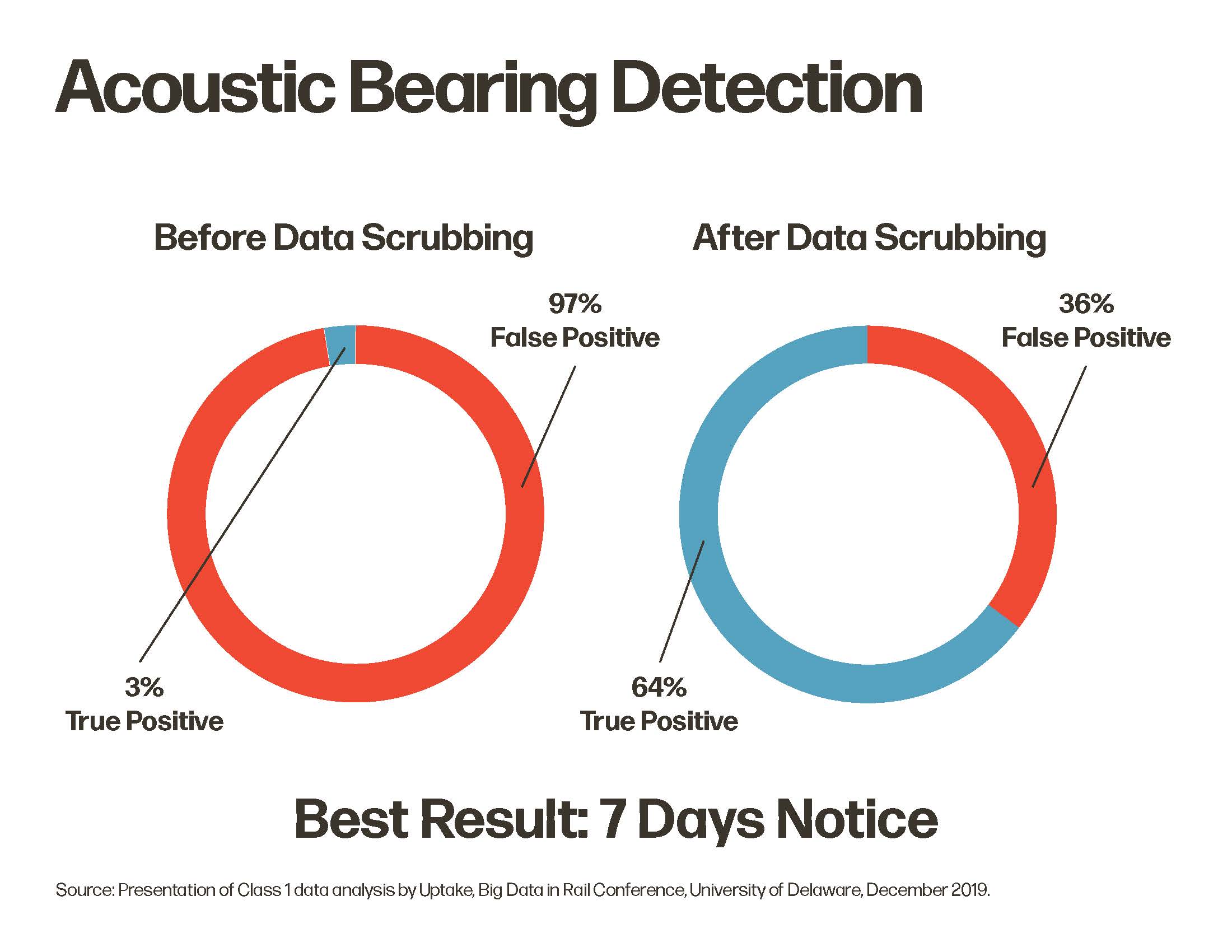

A case study shown below highlights the problematic nature of ABDs when the company performing the analysis on ABD data found a 97% error rate!! Even with extensive data scrubbing and other techniques, ABDs were only shown to improve the positive rate to 64% and a best alert time to 7 days, good enough for derailment prevention maybe, albeit at the expense of excessive train stoppages, but still a poor method of preventative or predictive maintenance for car owners.

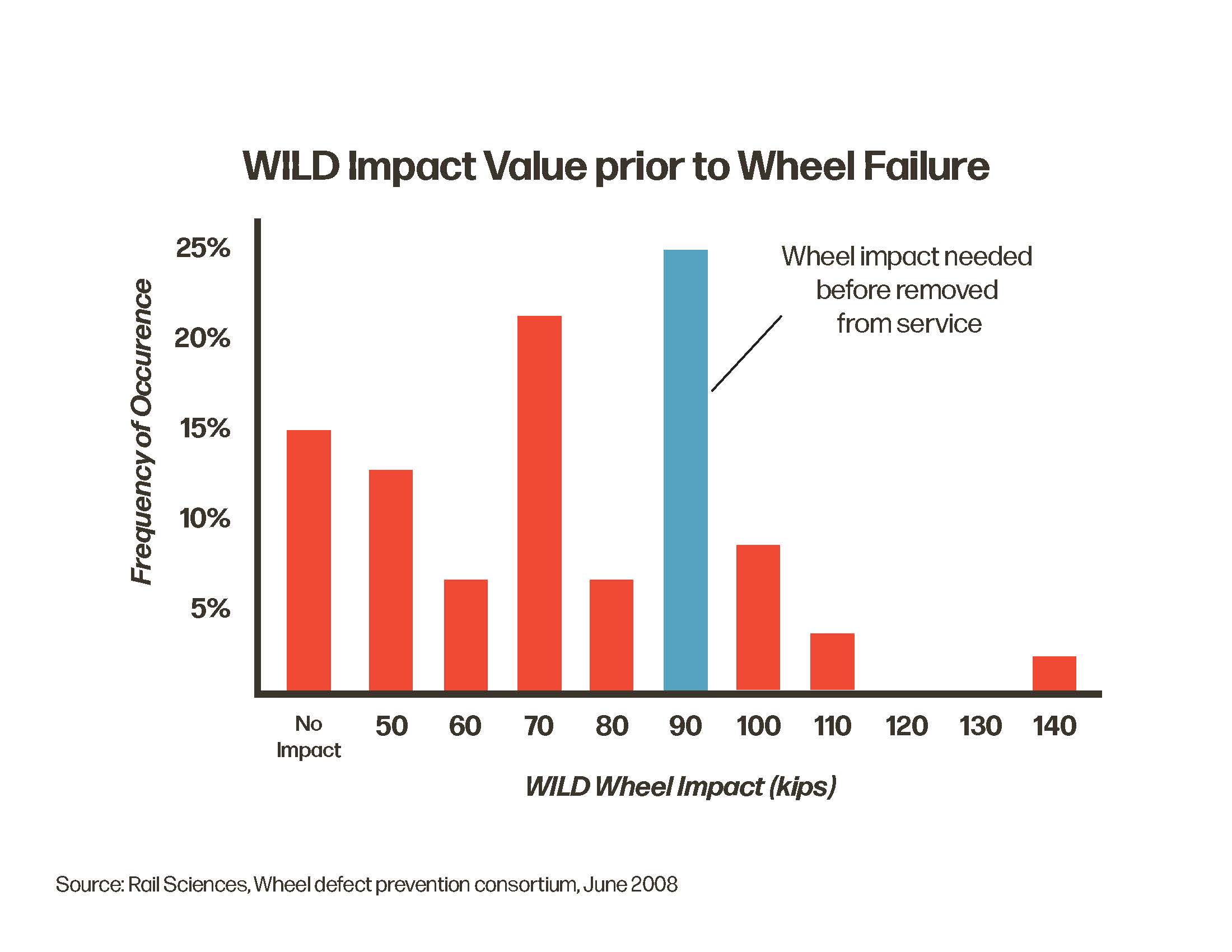

While certainly more useful to a car owner or shipper in terms of taking preemptive action than HBDs or ABDs, WILDs are not a foolproof method for predicting mechanical failure. As shown in the chart below, there is no correlation between WILD impact value, as measured in kips, and actual broken wheel failure. This hasn’t stopped the AAR from determining that wheels can be changed out by railroads as soon as they hit 90 kips (known as “Opportunistic” wheels). I’ve had multiple conversations with both current and former railroad managers who said they actively looked for Opportunistic wheels to replace because it was such a cash cow for them.

As one manager at a major repair shop mentioned to me, “The railroads tell us they’re not in the wheel repair business but all I can see is that we’re doing 60% fewer wheelset changeouts than we were a few years ago.” This sentiment certainly isn’t isolated and seems to reverberate across the industry.

Aside from flawed triggers for pulling wheelsets, railroad maintenance practices also show the problem with misaligned incentives between railroads and car owners. Railroads want to operate a fluid network without disruption, but they also have their own railcar fleets to maintain. Railcar owners, particularly lessors and private fleet owners, want to minimize total maintenance costs of their assets. These differing incentives are apparent in a common practice that I’ll call “preferential wheelset treatment.”

When a railroad has access to all the freshly removed wheelsets coming off the line, it has a big inventory of wheelsets that can be turned and put back into service. Given the cost of a turned wheelset runs around $600 and a brand new wheelset is $2900, is it any wonder when all those freshly turned wheelsets somehow end up underneath system cars and brand new wheelsets end up under private cars at their owner’s expense? UP is perhaps the most notorious Class 1 with this policy although others have told me CSX frequently does this as well.

If railroads viewed running repairs as an additional service that they can provide their customers, exhausting turned wheelset inventory on private cars would be a great way to deliver extra value. Instead, this practice sadly follows the same pattern all shippers see from railroads, “Our network and our business are more important than yours.”

Running repairs essentially function as a maintenance tax on shippers and car owners. If I'm a shipper with a full service lease, I might be fine to let the railroads and my lessors shoulder the burden for how my cars are maintained, but what happens when that downtime starts affecting my operation or when I have to lease additional cars to make up for the lost capacity caused by not having enough cars available? If I'm a railcar lessor or large private fleet owner that's invested in my own shops, why am I still paying high fixed costs to operate shops when I'm paying railroads for the bulk of my maintenance needs? There's a lot of money being left on the table right now by private car owners from both of these scenarios.

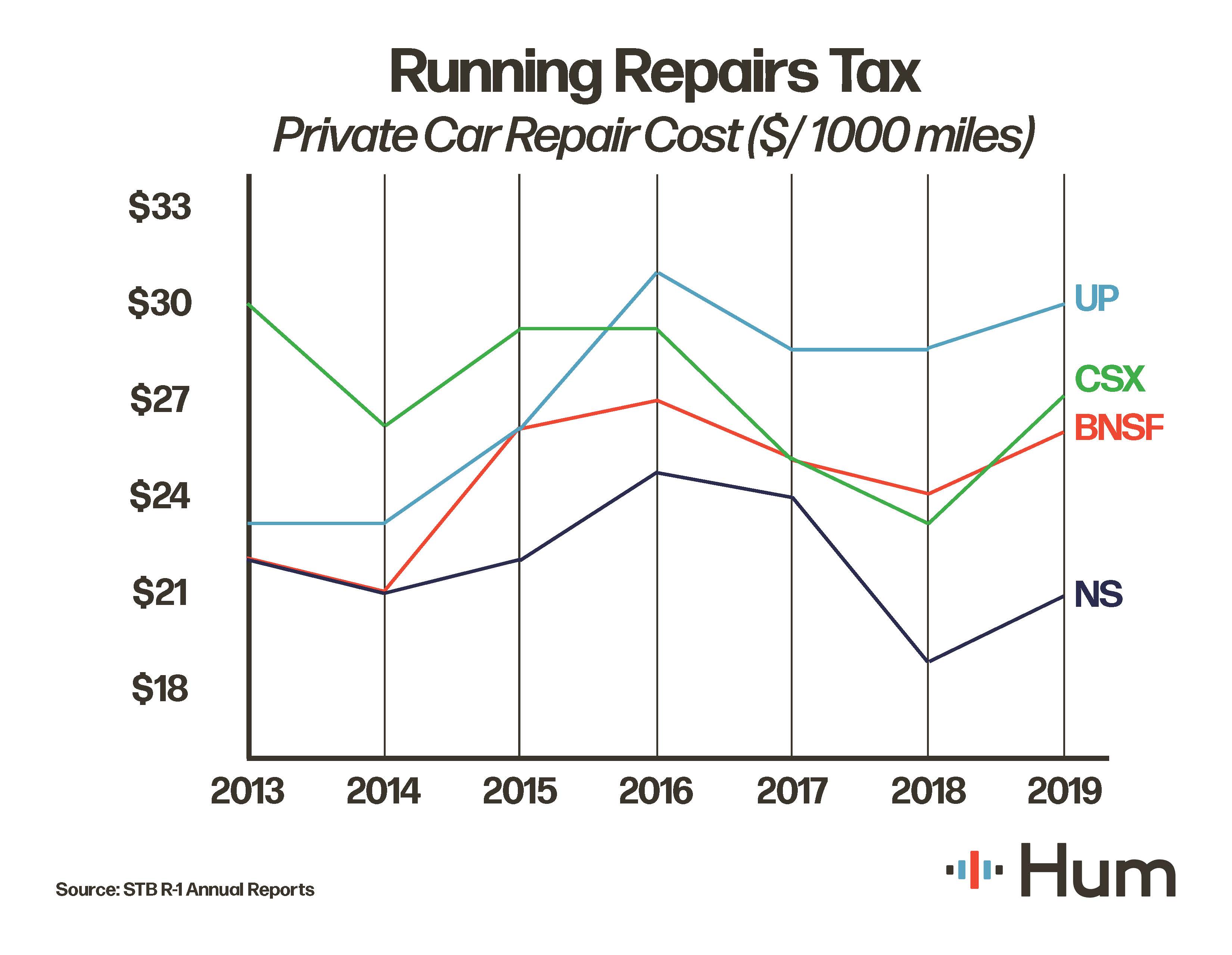

Shown in the chart below are the running repairs cost to a private car owner for shipping on one of the US Class 1 Railroads. This “tax” varies from railroad to railroad, but it’s one that shippers and car owners are forced to pay. What’s the recourse for a car owner who has a bearing flagged incorrectly by an ABD, pulled from service, and then sent a bill 5 months after the fact? Most car owners never see an MD-11 report let alone know when a non-verified bearing pull occurred. I've never heard of private car owners being allowed to audit wayside detector data.

Fortunately, private car owners can do something to avoid paying out the nose on unnecessary or ill-timed repairs. At Hum we’ve developed the Hum Boomerang, a vibration and temperature monitoring device that attaches to each bearing adapter on a railcar and provides car owners with the ability to take control of their fleet maintenance. Live vibration and temperature data are monitored continuously by an advanced algorithm which predicts bearing failure more than 50,000 miles in advance.

The "Bearing Health Index" shown below is a Hum metric that synthesizes a variety of factors about each bearing including vibration signature, speed, geometry, temperature, and more to give a single value which approaches 0 as the bearing reaches its failure point. A "Wheel Health Index" providing a similar condition metric for wheels is currently in Beta testing and will be available in 2022.

This live bearing and eventually wheel condition data gives car owners the confidence they need to proactively maintain their railcars. As the Hum Boomerang utilizes a GPS-enabled Hum Gateway for data transmission, Hum-equipped railcars provide live location reporting in addition to equipment condition.

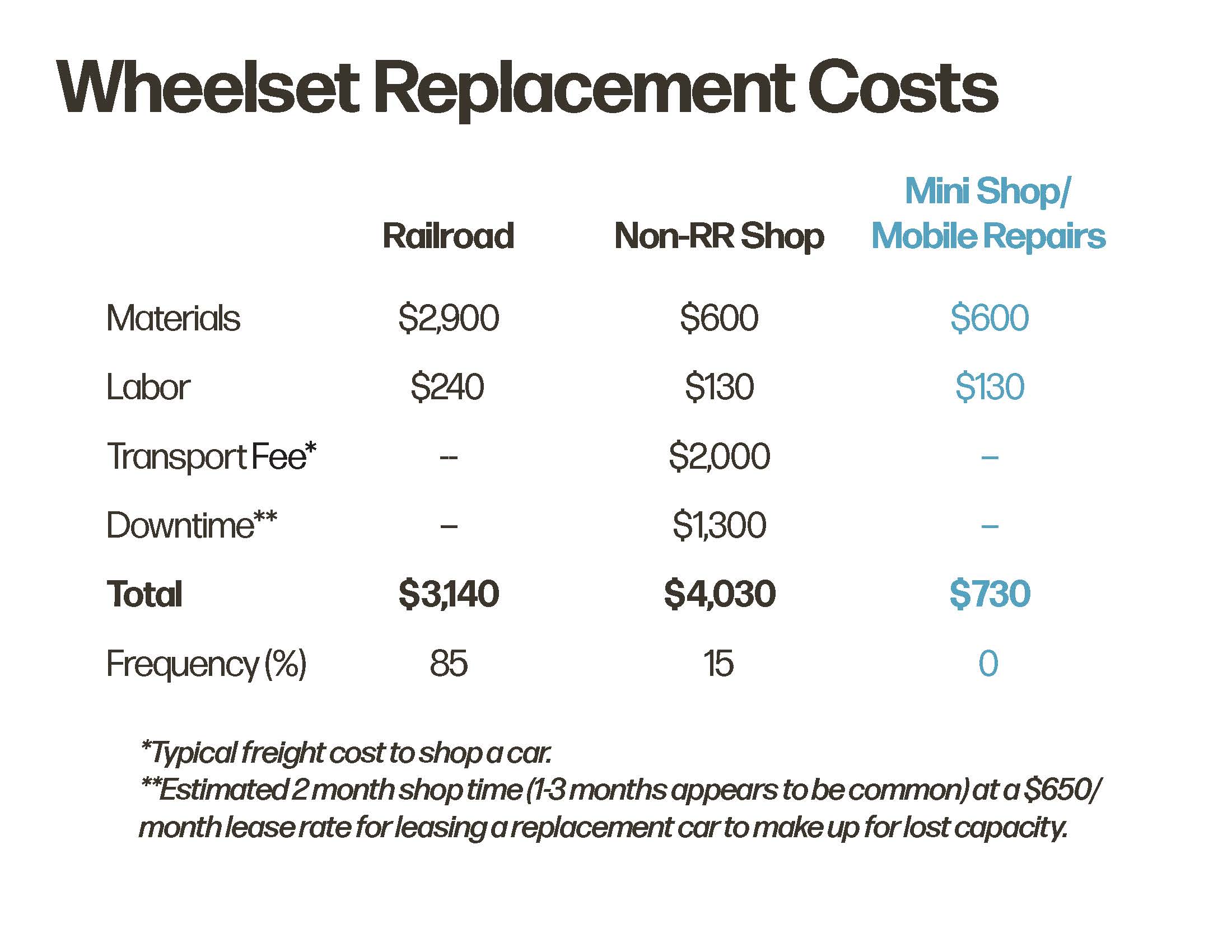

One common rebuttal I've heard from private fleet managers is that since they're already paying the wayside detector tax the additional cost to shop their car and perform the maintenance themselves doesn't pencil out. They're right, in most cases. As the table below shows, even with the high cost of a brand new wheelset and the more expensive AAR labor rate than one can find in a non-union contract shop, the $2,000 freight cost to shop a car is just enough to put most private car owners off from trying to run a proactive maintenance program. Moreover, utilizing a "Mini Shop" (onsite repair crew) or a mobile repair cost gives private fleet owners the best of both worlds: full control over their wheelset maintenance without paying the freight cost to shop the car.

With GPS location and accurate wheel and bearing data private car owners can finally take back their wheelset maintenance from the railroads, unlocking both lower cost per changeout and higher fleet utilization. Large lessors with their own shop network will be able to run fully utilized shops lowering their total fleet maintenance costs as well as providing their customers with the right maintenance service. Private fleet owners can call on mobile crews or set up their own onsite shops to achieve dramatically lower maintenance costs without any downtime. Why can't a mobile repair crew roll up to a shipper's yard with a flatbed of half a dozen to a dozen wheels and get them all knocked out in less than a day while those cars are sitting? Hum's Mobile Railcar Monitoring system unlocks a variety of new possibilities.

If you've long been frustrated by costly running repairs or if you'd like to really move the needle on running a fully utilized repair shop network, contact info@humindustrial.com to get your hands on the Hum Mobile Railcar Monitoring system.